School District Funding

Is the school district being fiscally responsible?

- The "litmus" test, so to speak, for public school districts, is really the annual fiscal audit, which is a very rigorous process with the external auditors inspecting all aspects of the District’s financial management. A significant part of that process is the auditor's preparation of the financial statements of the District, which includes measuring the budgetary process and the results of that fiscal year. So, anyone who has financial interaction with the District, whether it’s a lender, banker, or credit rating agency, will immediately ask to review several years’ worth of audited financial statements.

- Furthermore, the annual budgeting process is open to the public. The District has a yearly session prior to the passage of the final budget, during which any member of the public can come and ask questions. Ultimately, as a public entity, school districts are subject to a very high degree of accountability and transparency. All of the District’s financial information is in the public domain and can be accessed by any member of the public.

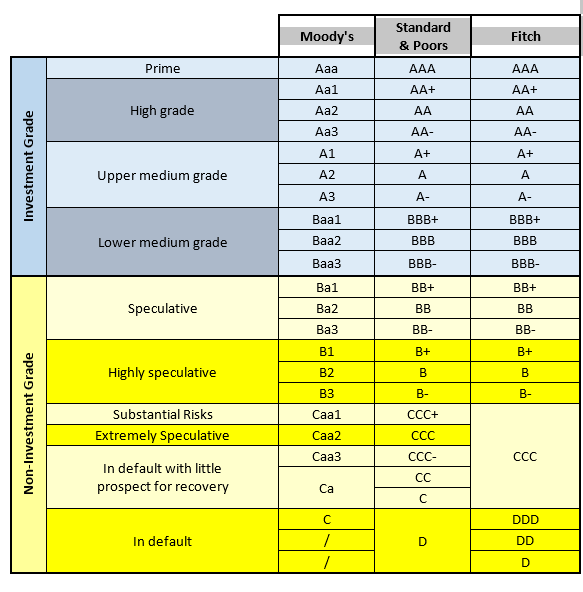

- The district has a AA+ bond rating, which is similar to an individual’s credit rating. AA+ is one of the highest ratings an organization can receive and is a distinction the RC Area School District shares with only three other school districts in South Dakota. Such a high rating signifies positive financial health and creditworthiness and saves the taxpayers money in interest.

Sources: https://www.spglobal.com/ratings/en/about/understanding-ratings

https://www.moodys.com/researchdocumentcontentpage.aspx?docid=PBC_79004

https://www.fitchratings.com/site/definitions

How is the school district funded?

- Public education has three primary funding sources:

- “Local effort” – revenue generating through the collection of local property taxes

- State aid – determined mainly by a per student allocation. The state funding formula for public education favors small, rural districts and is challenging for larger districts like RC.

- Federal aid

- A high degree of the financial burden for the cost of public education is put on "local effort” – (property taxes) in the state of South Dakota. Ultimately, the state also dictates the ability of a school district to generate their local revenue by limiting

onthe overall taxing authority of local governments. These are what we would refer to as levy limits. Many districts have chosen to opt out of the state-imposed levy limits on property taxes. RC District runs on a thin operating budget because our community rejected an opt-out about 5 years ago. -

From these funding sources, the District manages three main “pots” of funds:

- General Fund (GF)

- Funded roughly 45% from property taxes, 45% from state aid and 10% from federal grants. Cannot be transferred into the Capital Outlay Fund.

- Capital Outlay Fund (CO)

- Funded 100 percent by property taxes

- This fund pays for many things including curriculum, technology equipment, school buses, in addition to debt service on loans used to fund the new East/Valley View schools, Central High School additions, Coral Drive Classrooms, infrastructure improvements at North Middle and Meadowbrook Elementary and other smaller capital projects around the District.

- Special Ed Fund

- Funded roughly 50% from property taxes and 50% from state aid

How Changes to State Aid Formula Have Hindered the District

- A series of budget cuts and changes to the State Aid formula at the state level have contributed to difficult budget issues for the District. In South Dakota, local taxpayers take on the lion share of the burden for funding their schools. As the state aid formula changed over the years, it was not favorable to large Districts such as RCAS, as the State subsidizes small rural district with more dollars per student. Many districts in the state have struggled to deal with a sluggish funding formula, rising inflationary costs, and higher expectations from stakeholders.

- Over the last two decades, RCAS has utilized many strategies to try to maintain a balanced budget. These included programmatic cuts, changes to the transportation program, increased class sizes, and reduction of paraprofessional and instructional support positions.

- As changes to State Aid were made, the state gave school districts an option called Capital Outlay flexibility. This allows Districts to utilize a portion of their Capital Outlay revenue to offset General Fund deficits. With teacher’s salaries being the lowest in the nation, ultimately, the District felt it had to invest in its education program and began to use a small portion of Capital Outlay revenue to cover operational costs in the General Fund, which included a significant increase to teacher salaries.

- As the District’s enrollment and property valuations grow, its focus will be to lessen its reliance on the Capital Outlay flexibility, so that those funds could be used for facility projects in the future. If the bond is approved, and the District can retire several of its older facilities that require significant time and resources to upkeep and operate, this will provide relief to both the Capital Outlay and General Fund.

What’s an Opt-Out and What Does it Mean for RCAS?

-

A higher degree of the financial burden to support the cost of public education is put on "local effort" in the state of South Dakota. Local effort meaning the property taxes paid by citizens of the District to fund education. Ultimately, the state also dictates the ability of a school district to generate local revenue by the limitations it sets on the overall taxing authority of local governments. These are what we would refer to as levy limits.

-

Many districts have turned to opt-outs to help fund their regular education program and offset lagging revenue. As a matter of fact, about 50% of the districts in the state are utilizing an opt-out to boost revenue. RCAS pursued an opt-out back in 2015 that would have provided the District another $6-8 million/year in revenue to deal with increasing operational costs. The opt-out was defeated.

Several important points about these opt-outs:

1) An opt-out is only applicable to the taxes generated for the general fund and, therefore, can only be used for general fund purposes.

2) Opt-out revenue is meant for operational purposes, and it could not be used for large-scale facility projects.

3) The General Fund levy and so an opt out levy is graduated based on property classifications of Agricultural property, Owner occupied and Other or commercial property. It puts a larger burden on commercial property. The Capital Outlay and/or a Facilities bond is levied at one rate for each property class.

I thought that Gambling Revenue from video lottery was supposed to fund education in South Dakota. What happened to that notion?

The gambling tax revenue goes to the State general fund and from this fund the State pays a portion of local education funding called State Aid. This aid goes into the District’s General fund and pays for approximately half of the operating costs of public schools throughout the state. 85% of the general fund covers teacher and support staff salaries. The video lottery money allows the State to subsidize the cost of education, otherwise each community would have to fund a higher percentage of the costs through higher property taxes.

How is the Capital Outlay Fund used?

- Currently, the District’s annual Capital Outlay budget is approximately $25.6 million.

- Of this, approximately $5 million goes to instructional support. This includes computer leases for students and teachers, textbooks, and other curriculum materials.

- $8.7 million funds support services, including expenses for large equipment purchases for various school programs, technology infrastructure, technology purchases for support personnel, buses and vehicles, land and facilities acquisitions, and large-scale building and improvement projects.

- $6.2 million covers debt service, including debt on books.

- $172,000 to co-curricular activities for equipment purchases for extracurricular programs.

- Finally, the remaining $5.4 million is earmarked as an operating transfer for the general fund. This is referred to as “Capital Outlay Flexibility Revenue” and it funds a portion of general fund salaries. The district budgets this amount but has only used around $3 million a year in actual expenditure. The other is put in the Capital Outlay reserve fund.

- As you can see from the list above, the Capital Outlay fund has to be stretched to cover many broad needs and therefore, competition for these dollars is fierce. It also highlights the difficulty in funding the proposed large scale capital improvement needs with only the District’s “internal resources” – it is impossible.

- With all the demands on the Capital outlay fund, there just isn’t enough left over to fund larger school capital projects, which is why a general obligation bond is needed. If the district had to approach all the projects under the bond with a "one-off" approach, it would be at least 10-15 years between each of these projects.

Why did RCAS wait so long to address these deteriorating building conditions?

- Through the years, the district has been able to build facilities and do multiple renovation projects without asking for a property tax increase. In fact, seven schools have been built since the 1970s, including 5 elementary schools and 2 middle schools and a major high school renovation at Central. Unfortunately, the needs are mounting, and it is getting harder and harder to continue to band-aide some of these facilities. The Capital Outlay funds available to support the costs of these smaller projects is limited, which is why the community is being asked to support a bond for a larger scale investment in the capital needs of our schools. The Capital Outlay fund is also stretched to fund major deferred maintenance and pay the higher cost to maintain the older infrastructure in the majority of our buildings.

- With the available dollars, RCAS has performed various preventive maintenance projects including:

- North Middle School structure stabilization and preservation

- Meadowbrook Elementary structure stabilization and preservation

- Rapid Valley Elementary structure stabilization

- Rapid City High School structure stabilization

- The new HVAC system at Knollwood Elementary

- District-wide roof maintenance

- Energy upgrades throughout the entire district

How many school administrators are there?

- There is a total of 1,837 employees in RCAS with 53.5 being administrators, which is 2.9% of the total staff. The SD Department of Education lists the number of administrators on their site: https://doestatereporting.sd.gov/Nimble/asp/Main.aspx

How much did the remodel cost to the new Rapid City Education Center (administration building)? Where did these funds come from?

- If the RCAS administrative offices had remained in their former location in the City/School Administration Building, the District would have needed to invest $7.5 million in required expansion and renovations. The cost to renovate the new administration building (The Rapid City Education Center) was $4.2 million. So, the District saved $3.3 million by moving to the new building. The cost of the Rapid City Education Center building was paid for with money the District received from the City’s “buy-out” of the District’s portion of City, School Administration Building. The renovation dollars for the new location came from the District’s Capital Outlay fund.

Bond Details

How is the bond structured?

- The bond structure is complex but is used by many districts across the country. Repayment is not a straight amortization like our homes are typically financed. The bond payment will grow over time. As the bond payment grows, so will the community. More people plus an increase in the total property valuations will ensure the District can meet the annual debt service obligation as it increases over time. Total principal and interest payments begin around $8 million and incrementally increase to around $18 million at the end of the bond’s 25-year term. The levy associated with this general obligation bond is $.85 per 1,000 in valuation, regardless of whether the property taxed is residential, commercial or agricultural property. At a rate of 4% growth over the 25-year payback of the bond this levy will cover the principal and interest payments each year.

- This bond structure assumes that the community will see a 4 percent increase in valuation each year. This growth over the 25-year payback of the bond, allows the $.85 levy to fully cover the principal and interest payments each year.

This is a conservative valuation increase as growth in our community has exceeded 5 percent in recent years. At 5% growth, the levy to meet the payment that year will be lower than $.85/1000 because the payment is fixed regardless of growth. The District cannot collect more than the annual payment. If the valuation is less than four percent, and the revenue from the levy at .85 will not meet the debt service in a given year, then the district will make up the difference using Capital Outlay dollars.

- This bond structure is a common practice and is used by districts throughout the country. It allows the district to be able to meet its most pressing facility needs while minimizing the impact on its taxpayers. The District worked with Mr. Toby Morris, of Dougherty & Company, LLC, in analyzing and structuring the bond. Mr. Morris has extensive public sector bond advisory experience and has worked with many schools and municipalities across the state over the past 20 years. Also, the District has received legal counsel on the bond from Mr. Todd Meierhenry, of Meierhenry Sargent LLP of Sioux Falls. Mr. Meierhenry specializes in the area of public finance and has worked extensively with bond issues.

How can we be sure the district won’t change their mind on how the money is used?

- The use of bond proceeds for purposes other than stated in the ballot is strictly prohibited. Because the interest on General Obligation Bonds is tax-exempt, IRS regulations strictly regulate the use of the proceeds to fund the listed capital projects only. Under no circumstances would the proceeds be able to be used for operational purposes as the ballot language does not state this purpose.

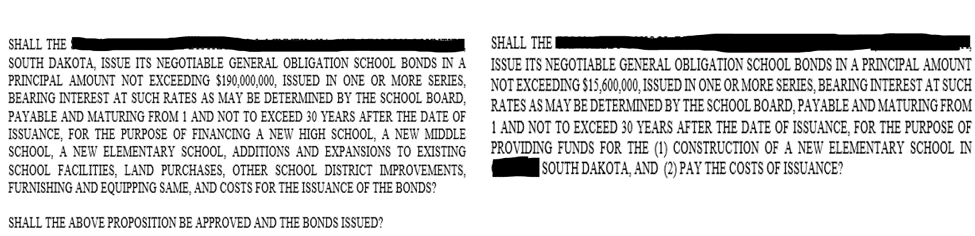

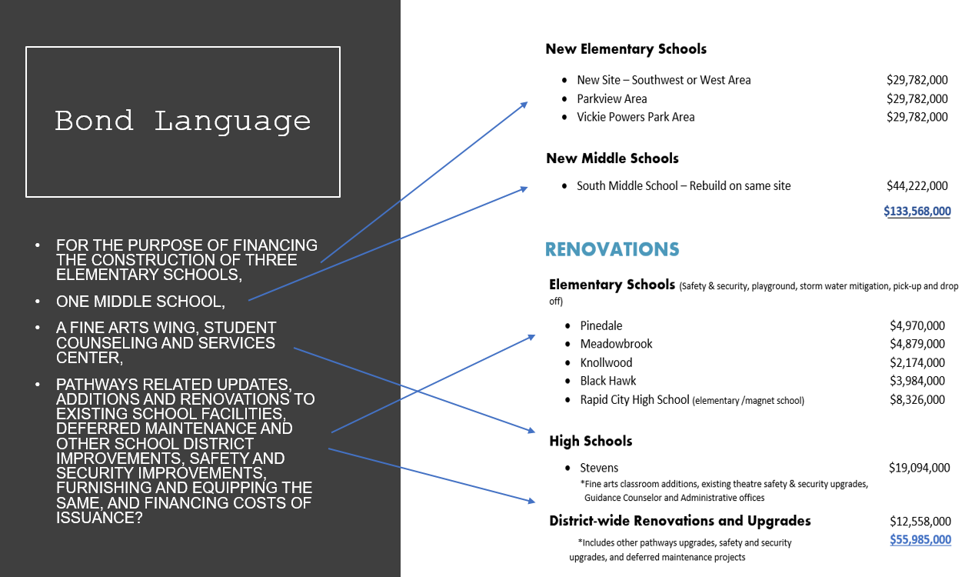

- The ballot language that the District has proposed describes the projects and usage of the proceeds and uses language commonly found in General Obligation Bond ballots around the state. Those documents are in the public domain and may be accessed by the public for review. See the October 28, 2019 Board minutes for the official document. The District has retained legal counsel that is highly experienced in bond planning and execution and fully understands the proper usage of bond proceeds. Here are a couple examples of ballot language from other South Dakota bonds:

- See the October 28, 2019 RC School Board minutes for the official bond resolution. The District has retained legal counsel that is highly experienced in bond planning and execution and fully understands the proper usage of bond proceeds. The ballot language ties directly to the language in the School District’s proposed facilities plan as described below:

How will the bond be paid off?

- The proposed amount of the bond is $189,553,000. This amount would be amortized over a 25-year period.

- The District will utilize a graduated debt service schedule, in which the total principal and interest payments incrementally increase throughout the 25-year life of the bond. This structure allows the District to factor in valuation increases so that, as more homes are built and more businesses open or move to town, so does the bond levy revenue, which allows the District to keep pace with the increasing debt service payments while lessening the burden on current taxpayers.

What will the bond cost me?

- Under the assumed structure, the District used to evaluate the bond, the 85 cents per $1,000 of valuation levy is the “break-even” point in the debt service analysis; meaning, the point at which, when factoring in the assumed growth rate, the levy could meet the debt service obligations throughout the life of the repayment period.

- For example, on a home valued at $250,000, the annual cost would be $212.50 – that’s $17.71 per month.

- The $.85 per 1,000 in valuation is the same regardless of the type of property taxed. All residential, commercial and agricultural property would be subject to the same $.85 levy.

- It’s very possible that as the community grows, the tax burden will remain the same for homeowners or even decrease because the tax will be spread over a bigger base.

Is a 4% percent annual growth rate assumption reasonable?

- To assess the likelihood of 4 percent growth in the District’s valuation, one might reasonably look to the many positive projects and investments being made in our region, including:

- Ellsworth Air Force Base Expansion

- Elevate/Accent Center - Business Development efforts

- Investments by Monument Health system, the Civic Center, Black Hills Energy, etc.

- DUNE Project at Sanford Lab

- Facts further supporting our community’s growth –

- The headline on the RC Journal on Jan. 3, 2020 read, ”Rapid City sets record for building permits in 2019.” 2019 was the 4th consecutive year this valuation surpassed $300 million. Residential housing permits were also at a 5-year high.

- Rapid City planners expect up to 5,000 new homes to be built here in the next 3 years. One can reasonably assume that some of these households will have school-aged children.

- Our Metropolitan Statistical Area (MSA) has seen an estimated 12.6% increase since the last Census was taken in 2010.

- Enplanements at RC Regional Airport broke records for the third year in a row and increased over 12% in 2019 over 2018.

- $200 million in TIFs will expire and the property becomes taxable in the next 5 years.

Some are saying the bond gives the School Board the arbitrary ability to raise the levy to fund other things? Some say this could be as high as $3/1,000 valuation. Is that fact or fiction?

- Unfortunately, a few people in our community have ginned up a fear tactic and are spreading stories that the bond repayment will go up and up and will eventually cost taxpayers $3 per $1000 of valuation. This is nothing more than a gross misrepresentation of a legally required provision in the bond language. The bond will be repaid over time with annual payments that are set and known when the District enters the legal bond agreement. A property tax levy of $.85 per $1,000 of valuation is the specific income source calculated to make those bond repayments.

- Similar to your car payment, where there is a monthly payment or your mortgage with its own monthly payments – all three have one thing in common – they must be secured. Your car loan is secured in most cases by putting the car up for collateral, and your mortgage by putting the house itself up for collateral. Fail to make your payments, and the lenders foreclose and take away your car and/or your home.

- In contrast, general obligation bonds, such as this school bond, are not secured by using the buildings for collateral. Once it is passed, the bond will be sold and the buyers of the bond are guaranteed a return on their investment by the taxpayers. If the District cannot come up with the fixed dollar amount paid in a given year, it wouldn’t be feasible to foreclose on our property- what would a bunch of bond investors do with school buildings? Therefore, the language of the bond says that the District must increase the mill levy by only the exact amount needed to cover the exact dollar amount of the payment for that year – that is the guarantee. This is how school bonds work.

- But under what circumstance would an increase happen? The entire tax base of the School District – so the average of ALL of the homes, businesses, and land – would have to depreciate in value to such a degree that we would be short in making the bond payment using the tax levy of $.85 per $1,000. What kind of dire circumstances could cause such a condition? It would need to be a national economic failure or a huge natural catastrophe. It would have to be something big because the District tax base still grew even during the Great Recession in 2008-2009.

- If a community was afraid of taking out car loans, period, because their cars might be repossessed or of taking out a mortgage, because their homes might be taken away, one might say that the community had an irrational fear (and a pretty bad economy as a result).

- The fear that the District is going to raise the mill levy to $3 per $1,000 is NOT a rational fear. Bonds are structured this way all the time, and in every state, including ours. It is the way bond business is done. Like the car loan business and the mortgage businesses, which we depend on to have homes to live in and cars to drive to work, a bond will allow us to have decent schools in which to educate our children.

- There is plenty of fiction being spread by those who oppose progress in our community. The Board of Education cannot arbitrarily raise the capital outlay levy to 3 mills ($3/1,000 value) because the State legislature placed a cap on the fund within the education funding formula. The state formula mandates an annual increase that caps any year to year increases in the Capital Outlay levy. Scare tactics are full of false information.

Why are we not able to do a sales tax increase instead of a property tax increase?

- A sales tax has to be approved by the legislature or a city. There is not a mechanism in place for a school district to increase the sales tax. The sole option the Legislature provides for school districts to make large scale facility improvements is a general obligation bond, which increases property taxes to fund the investment in our schools.

Can the school board arbitrarily increase my taxes?

- In the unlikely event that valuation depreciates, the Board could increase the mil rate in order to meet its debt obligation. This is not a likely scenario. Even in a worst-case scenario where the levee did have to increase, it could never be arbitrary. The District could only collect up to the total amount of debt service payment in a given year. So, the Board could never increase the levy because they felt like it.

What happens if property values decrease?

- In the highly unlikely event that the entire district tax base depreciates, and the bond obligation could not be met, only then could the Board increase the levy in order to meet its debt obligation. This is standard bond language, not an attempt to deceive voters. This is also why taxpayers must vote on a bond, you will guarantee the debt because you see the investment is of value.

- It’s worth noting that the 10-year average valuation increase for the District is more than 3 percent, which included a major recessionary period, and for the past six years the average has been more than 5 percent. There are many signs supporting optimism regarding this community’s growth. If the tax base grows at a faster rate than predicted, the levy amount would likely decrease. However, the Board has stated its intention to cover any “gap” with its Capital Outlay dollars.

This school bond is just for phase one of the projects the district has outlined. Will the district ask for another levy for phases two and three?

- While the independent third party the District hired in 2015 (MGT) to study our facility’s needs suggested a Phase 2 and Phase 3 to address future capital needs, the Task Force nor the School Board recommended any additional Phases, primarily because it is so challenging to anticipate future needs. However, it is a reasonable assumption that a growing community may have additional facility needs at some point (and likely before another 46 years pass).

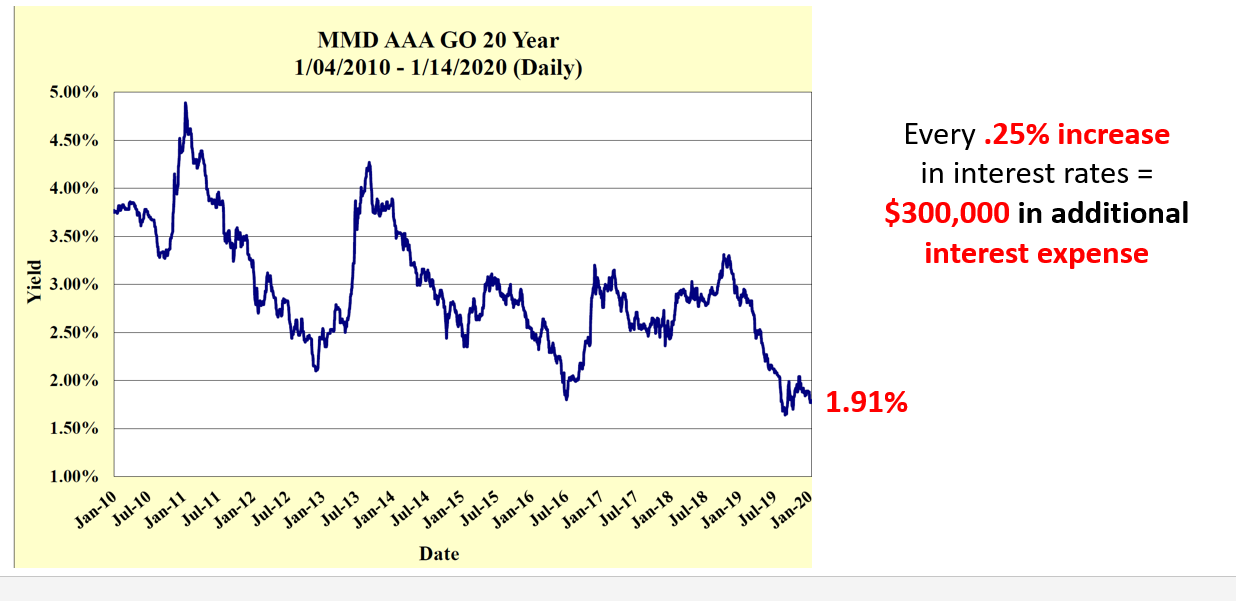

Why should we pass the bond now?

- With interest rates at historic lows and construction costs only likely to continue to increase, it would be foolish to wait. Our aging facilities aren’t going away…they just get more expensive to fix the longer we wait.

- So, every year we push these projects down the road and don't address them, it exponentially adds to the cost which ultimately comes out of the taxpayer's pocket. It would be irresponsible to the taxpayers of this district NOT to pursue these projects at a time when interest rates are so favorable. Bond rates change daily but are currently under 2 percent.

Source: MMD index - Municipal Market Data

How can I check to see if I qualify for a tax freeze or tax assistance?

The South Dakota Department of Revenue offers financial assistance to the elderly, disabled and veterans through tax refunds and assessment freezes for those who qualify. To learn more, go to: https://dor.sd.gov/individuals/taxes/property-tax/relief-programs/

Facilities

How was the decision made to build three new elementary schools and one new middle school?

- After several years of study, analysis, and discussion, the decision was based on what would cover the greatest needs in the district. Those needs include capacity needs to best suit the student population in each area, replacing old buildings with failing infrastructure and unsuitable education environments and safety and security needs:

- Vickie Powers Park – elementary students living north of Lowe’s/Best Buy are bussed to Canyon Lake Elementary because there is not an elementary school in this neighborhood and the closest school is near capacity. The school district owns the land at Vickie Powers Park.

- Southwest or West Area – based on planned housing development and Corral Drive already being overcapacity, a new school is needed in this area. The land will need to be purchased for this building if it is placed in the Southwest area.

- Parkview or Southeast Area – due to the significant structural issues at Robbinsdale, it would close once a new facility is built. The district owns land in the southeast area of Rapid City (near south side Walmart and Parkview pool) which is a potential site for a new elementary school. Once this school is built, boundary lines would shift between the schools in the area which currently include South Park and Grandview.

- South Middle School – a new school would be constructed behind the existing building and, once completed, the current building would be torn down.

How long will it take to complete all of the projects listed in the bond proposal?

- All of the projects will be completed within six years.

What would three $30 million elementary schools look like? What would the $45 million middle school look like? Are we getting a Chevy Impala or a Lexus?

- A $30 million elementary school will meet students’ needs today and in the future. The building will be constructed using sustainable products to keep maintenance costs down. For example, geothermal systems would be used for heating and ventilation. Playgrounds would have protective services – not pea gravel like is currently use. The building and playground would be ADA accessible and have safe pick-up and drop-off lanes. Each entrance would meet modern safety security needs. Additionally, each classroom at the elementary level will be a minimum of 900 square feet and bigger at the middle school level. The classrooms and group workspaces would have natural light, noise control, individual heating controls, individual and group workspace and other features that have been shown to enhance student engagement and learning and teacher retention. The price increase for middle schools comes as a result of more square feet to meet capacity needs. There will be space on-site to add to a building should we need it.

- The costs include furnishings, architecture fees, and any required site modifications. In response to the comparison of an Impala or a Lexus – we would not include luxuries like a granite floor, but the schools will be built to last, which means the facilities won’t have sheetrocked walls, but masonry walls. Investment in more sustainable products upfront will allow the District to recognize the savings in maintenance costs for decades to come.

Would a $19 million fine arts wing at Stevens High School resemble Carnegie Hall?

- No. That $19 million figure includes the addition of classrooms and ADA improvements and theatrical lighting upgrades to the current theater. It also includes new practice spaces, improvements to the student counseling and services areas, and safety and security measures throughout the buildings. It will pay for things like asbestos floor tile abatement, fire sprinklers, school parking lot and site modifications.

So, what about Phase 2 and Phase 3?

- While the 2015 MGT Study recommended several phases of capital improvements, neither the Task Force nor the School Board identified or recommended a Phase 2 or Phase 3. This was simply because it is challenging to predict the needs of the District after 5-6 years, as the impact of EAFB’s expansion and other positive efforts driving growth in our community is still unknown.

- However, it is a reasonable assumption that a growing community will need to continue addressing capital investments in its facilities, and likely before another 46 years pass.

- Passing the bond allows the District some flexibility to utilize its Capital Outlay fund to potentially fund smaller capital projects like West Middle School and additions to crowded elementary schools like Rapid Valley.

What does $30 million for deferred district maintenance mean? Are the roofs caving? The foundations crumbling?

- These dollars would be used to update obsolete light fixtures, energy-inefficient single-pane windows and doors at our older buildings which do not need replacing at this time, heating systems, and fire sprinkler systems. These funds would be used to do hazardous material abatement, ADA upgrades, elevator upgrades, keyless access systems, and other security improvements. These funds would also be used to convert classrooms into a lab and other spaces for STEAM and Pathways programming.

Did the task force consider accessibility issues for students (and the public) with physical disabilities and ADA when making its recommendations? If so, how is this reflected in the plan? If not, please explain why.

- Absolutely. New buildings will be ADA accessible. There is also money in the plan to address some areas that are not ADA accessible in some of our older buildings including Stevens High School.

What is happening to the District’s Alternative High School - Rapid City High School?

- This six-year facilities plan includes re-purposing the Rapid City High School (RCHS) building as a future elementary school.

- At present, the alternative high school program at RCHS only partially utilizes the building. The greatest needs in the District are in the elementary grades, based not only on student numbers but also educational suitability and class sizes in elementary schools.

- With the newly established educational initiatives taking root at RCHS, the alternative high school has enjoyed huge success. The goal is to find space for this alternative high school programing that not only meets the needs of their new programming but enhances it. A number of options are being explored now, but some time is needed to give the new program time to be fully implemented in order to better understand its facility needs. Neither the school board nor the administration is planning to eliminate or marginalize the Alternative RCHS program in any way.

Capacity

What is capacity?

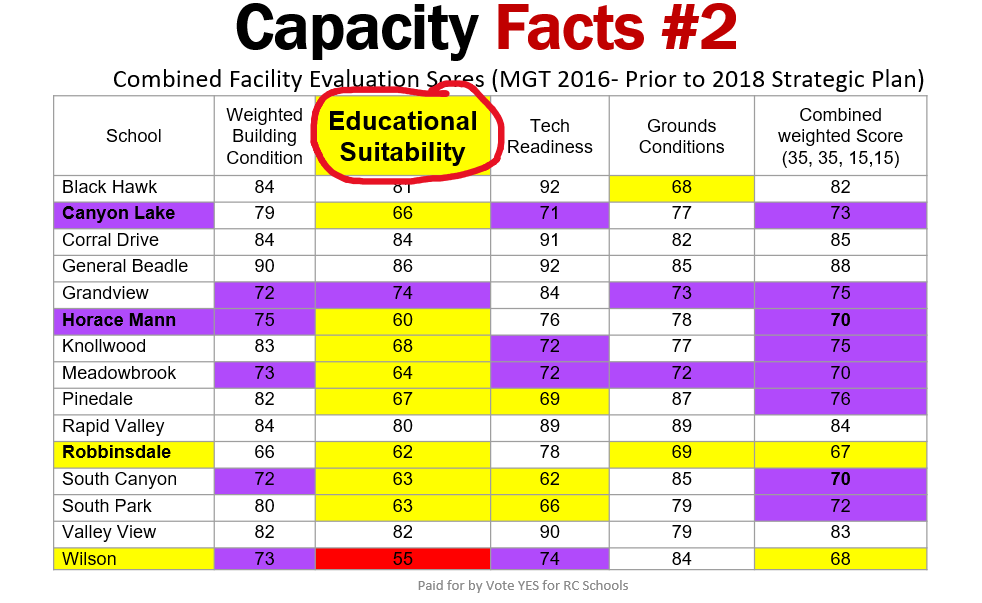

Capacity is more than just the number of students a school can hold. The measure for capacity must also take into consideration the educational suitability and functionality of a school. The majority of RCAS’ buildings were ranked by MGT, a third-party consultant the District hired in 2015 to evaluate the District’s facilities, as “poor” in educational suitability, with Wilson ranking as “unsatisfactory”. The buildings being proposed for replacement with the funds from the school bond are the lowest-scoring on the combined evaluation score.

Please reference the MGT study on the School district website for more information.

Ranking scale

- < 59% Unsatisfactory

- 60-69 Poor

- 70-79 Fair

Educational suitability measures how well a facility supports the educational program it houses, including factors like:

- Environment- safe and positive, natural lighting, adequate temperature control including not hot or cold spots in classrooms.

- Circulation – drop-off, pick-up, and playgrounds

- Support spaces – classrooms, special programmings like libraries, music, stem labs and support spaces like cafeteria and gymnasium

- Size - flexible learning spaces including independent learning and group collaboration space

- Location – gyms located away from quiet spaces, etc.

- Storage and fixed equipment – utilities, flooring, windows, etc.

How is a school’s capacity determined?

Capacity changes depending on how space is utilized. Using the example below, in the first scenario, the capacity is 150 and in the second example, the capacity is 135. Even though this is the same building, the capacity is different because the utilization changed. In the first example, there are two 2nd grade classrooms. In the second example, there is only one 2nd grade classroom because a special education classroom was added. Special education classrooms typically have no more than ten students. As a result, the capacity has decreased by 15 students in the second example.

School with Total Capacity = 150

|

Kindergarten |

Kindergarten |

|

1st Grade 25 |

1st Grade 25 |

|

2nd Grade 25 |

2nd Grade 25 students |

|

3rd Grade 25 |

3rd Grade 25 |

School with Total Capacity = 135

|

Kindergarten |

Kindergarten |

|

1st Grade 25 |

1st Grade 25 |

|

2nd Grade 25 |

Special Ed 10 students |

|

3rd Grade 25 |

3rd Grade 25 |

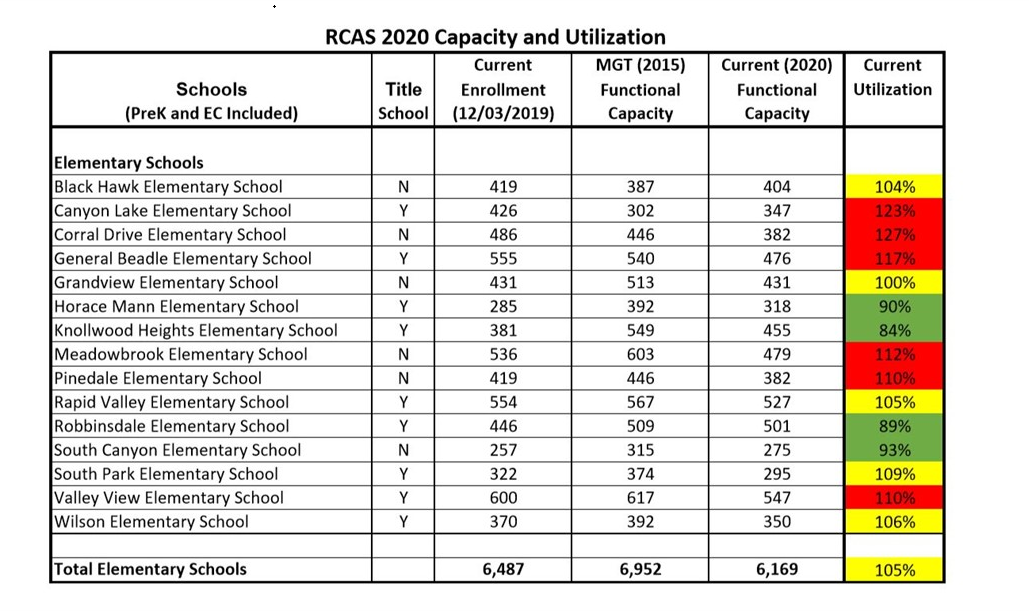

The current 2020 functional capacity, taking into consideration the District’s strategic direction, optimal class size for elementary and the increased need for Special Education classroom space has decreased to 6,169, causing additional capacity challenges.

Which schools have capacity challenges now?

In 2015, the District’s functional capacity and utilization at the elementary level district-wide was 6,952 students.

Currently, 11 of our 15 elementary schools are at or above functional capacity.

Schools at 100-109%:

Black Hawk Elementary

Grandview Elementary

Rapid Valley Elementary

South Park Elementary

Wilson Elementary

Schools above 110%:

Canyon Lake Elementary

Corral Drive Elementary

General Beadle Elementary

Meadowbrook Elementary

Pinedale Elementary

Valley View Elementary

What are the optimal class sizes?

- The district’s strategic plan identifies the optimal K-2nd grade class size to be 21 and 3rd-5th grades to be 25 to 28 max. Currently, most classrooms have 25-30 students. Smaller class sizes at the elementary level will help the district reach its strategic plan goal with an emphasis on early learning and reading by third grade.900 to 1,000 square feet in each classroom is optimal by today’s standards. In many of our older schools, the classroom size is only 500-600 square feet.

Is it true that the District is moving away from the concept of neighborhood schools and will eliminate bussing too?

Bussing will not end; however, this proposal does place schools in places where there are large concentrations of kids. As a result, more kids will have schools closer to their homes and fewer kids will need to be bused.

The fact is, the District currently busses many kids into town and across town because they do not have a neighborhood school.

- Currently, 174 kids from north of the interstate are bused to the west side of town because of overcrowding in the North Rapid elementary schools. The proposed new Vickie Powers elementary site will allow these students from the Mall Ridge area to have a school closer to their home and it is within walking distance from Lakota Homes neighborhood. This school will also serve the many kids in planned neighborhoods north of I90. While some Horace Mann students may be bused to the new school at Vickie Powers, others may be moved to General Beadle.

- Many of the other Canyon Lake Elementary students will go to Meadowbrook. Meadowbrook is .9 miles away from Canyon Lake Elementary.

- Depending on where the student lives, Robbinsdale kids would either go to SouthPark, which is .7 miles away from Robbinsdale or Grandview Elementary, which is also .7 miles away from Robbinsdale.

- Many of the Wilson students are currently bused. Out of about 372 students, 160 ride the bus and many of these would attend the new elementary school proposed for the Parkview property owned by the district. Wilson Elementary students would move to Rapid City High School which is .8 miles away from Wilson.

We are not moving schools out of neighborhoods. We are doing the opposite. We are placing schools in neighborhoods where there are already large concentrations of students and where there is anticipated growth.

Why not build a third high school?

-

The high schools are not overcapacity. The immediate need is at the elementary level where numbers are up significantly. Those capacity concerns are starting to carry over to the middle school level. Currently, RCAS owns land in Rapid Valley. Eventually, a third high school could be built there. The speed at which our community grows over the next few years as a result of the base expansion could expedite timelines.

Who is funding and paying for the yard signs and other Vote YES materials?

- Per state law, the school district cannot use taxpayer money to advocate for a campaign, only educate about an upcoming election. Vote YES for RC Schools is a registered ballot question committee. We file campaign finance reports with the school district per state election laws. Funding for Vote YES for RC Schools comes from individuals, organizations, businesses, and entities. We are a separate, standalone committee asking people to vote YES on the school bond.

Can I vote if I don’t live within Rapid City limits?

- Possibly. Anyone who lives within the district’s attendance boundary can vote. This includes families that live outside Rapid City’s boundary and even some voters in Meade County. Not sure if you live within the attendance boundary? Enter your name and information here to find out: https://vip.sdsos.gov/VIPLogin.aspx

Do building improvements lead to better educational outcomes?

- There is research that shows school facility investments lead to modest gradual improvements in test scores, large immediate improvements in student attendance, and significant improvements in students’ effort.

- Research also shows that a new school is advantageous to students, even if it means they have to take a bus. On a side note, reliable transportation often improves attendance. There is a strong body of research that shows school facilities can have a profound impact on both teacher and student outcomes.

- With respect to teachers, school facilities affect teacher recruitment, teacher retention, teacher commitment, and effort.

- With respect to students, school facilities can affect student health, student behavior, student engagement, learning, and growth in achievement.

https://sites.psu.edu/ceepa/2015/06/07/the-importance-of-school-facilities-in-improving-student-outcomes - Certainly, overcrowded classrooms (ill-suited facilities) impede learning. Eleven of our 15 elementary schools are over capacity currently, and this is likely to get worse as our community continues to grow. As an example, we currently have up to 30 kids packed into elementary school classrooms when 25 would be ideal. Trying to meet the varied student needs within such a large classroom is challenging for our teachers, to say the least.

What happens if the bond does not pass?

- The District will have to make adjustments, many of which won’t be ideal, but nonetheless are necessary.

- Here are just a few things the District would need to do to accommodate shifting growth, current capacity issues, and future growth.

- Continue to force transfer students, especially those who live in growing communities in the Southwest and East parts of the City.

- Immediate boundary shifts and adjustments to alleviate the crowding in those high growth areas of town. These were well researched and vetted by the Facilities Task Force and found to be less than ideal to solve the district capacity and educational suitability needs.

- Increasing elementary and middle school classes at some schools will likely continue. This could mean as many as 30 students at K-2, 32 at 3-5 and 35 students in class in grades 6-8. Consider adding more annexes.

- The District must plan for the possibility that they will have to close one or more of the aging buildings due to the condition. That would mean that they would have to look at alternative sites to place kids or potential schedule changes

How are educational outcomes being addressed by RCAS?

Three years ago, Rapid City Area Schools (RCAS) began implementing its ambitious 5-year strategic plan with one broad goal in mind – to improve outcomes for all students. They are starting to see some encouraging results. Recently, the state released its annual report card. In most areas, RCAS scores have improved – dramatically in some cases – over the year before, including:

- Rapid City’s two comprehensive high schools are performing above the state in both math and English Language Arts (ELA).

- Our elementary ELA scores have increased, particularly at the 4th-grade level. Six of the 15 elementary schools in our district saw their scores climb by 10 percent or more last year in one or more grade levels.

- Math scores are up at the elementary level. Seven of our 15 elementary schools saw a 10 percent or more increase in one or more grade levels.

- Math scores at the 11th-grade level are up. ELA remained the same.

- Graduation rates continue to climb each year. In fact, our overall graduation completion rate has climbed by seven percent between 2015 and 2018.

The District’s ELA scores remained the same for our middle school students, but middle school math scores dropped. Fortunately, The District is looking at a new curriculum to strengthen math proficiency at the secondary level. The new curriculum will be selected this school year and rolled out next school year.

Although science scores dipped last year, there are a number of new efforts happening in the District this school year aimed at strengthening our STEM efforts. STEAM2 (science, technology, engineering, art, math, and medicine) programming is now in all elementary and middle schools.

While state report cards and assessment data are important performance indicators, there are a number of other initiatives and happenings in our District that show RCAS is a District focused on growth and innovation.

- More high school students than ever before are engaging with community businesses through work-based learning opportunities. More than 537 of our high school students earned industry certifications last year.

- RCAS is set to launch the RCAS Academies at both Central and Stevens High Schools in the fall of 2020.

- The District has more volunteers than ever before at 293 and growing, and 280 businesses have partnered with RCAS to work with students in one capacity or another.

- RCAS has one of the most elite fine arts programs in the region, winning state competitions and representing the majority of students in all-state competitions.

*For further information, please refer to the MGT Study and other content at the RCAS District website at http://www.rcasfuture.org/